How to Dodge the Utility Billing Pitfalls that Crush Cash Flow

Sir Richard Branson put it best when he said: “Never take your eyes off cash flow because it’s the lifeblood of the business.” Maybe it’s because we’re obsessed with facilitating the flow of funds for our customers but we couldn’t agree more with Sir Richard. When that lifeblood slows down or stops flowing, all aspects of the business suffer.

In an effort to improve their cash flow, more and more property management companies are shining a light on their expenses and implementing a utility management solution that recoups these costs from residents. Because consumption-based billing is complex and time consuming, most property management companies are outsourcing the initiative to third-party providers. Unfortunately, in some cases, management companies are seeing a big difference between what’s recovered and what they shell out to the utility companies each month. They are left questioning if it’s even worth it.

Whether or not you currently rely on a third-party billing company to recoup utility costs from residents, it’s imperative to recognize the traps that can befall management companies that take on a utility billing program. Too many billing programs seem clear-cut on the surface but hide fees and complexities that end up costing multifamily companies thousands of dollars a year. Before you know it, your cash flow is in a slump, your property managers have extra tasks on their plate, and your resident satisfaction is plummeting.

So how do you avoid these pitfalls when implementing a program at your properties? Understanding the different models providers use to recoup utility costs from residents will help you identify outdated processes and select the best solution for your portfolio. In this article we’ll compare and contrast the primary utility billing models used by providers to help you identify outdated solutions that negatively impact your cash flow.

Bill-and-Collect Versus Resident Billing: Can you Spot the Difference?

There are two main billing models third-party providers use: utility bill-and-collect and resident billing. Bill-and-collect was the first utility billing model available to property managers and hasn’t evolved much in the 15+ years it’s been around.

Free eBook: Multifamily Utility Bill-and-Collect Schemes Exposed

Responsibilities of a Utility Bill-and-Collect Provider:

- Read the property management company’s utility bills

- Calculates resident utility charges based on utility bills or submeter reads

- Send residents a statement labeled with the billing company’s name

- Collect payments from the residents

- Follow up with residents who don’t pay

- Charge late fees for non-payment

- Reimburse the management company after residents pay

In recent years, Resident Billing has emerged as the preferred method for multifamily utility management. Advances in technology have allowed providers to leverage automation and streamline the process to drastically speed up funding times for property management companies.

Responsibilities of a Resident Billing Provider:

- Retrieves resident data from property management software

- Pulls property utility bills through automated data feed

- Calculates resident utility charges based on utility bills or submeter reads

- Generates white-labeled resident statements that includes rent, utility charges, and any other applicable property charges (parking, pet rent, etc)

- Delivers an online payment portal for residents to directly pay their property manager

- Integrates payment data into property management software

Why It’ll Take 105 Days to Get Paid When You Use Bill-and-Collect

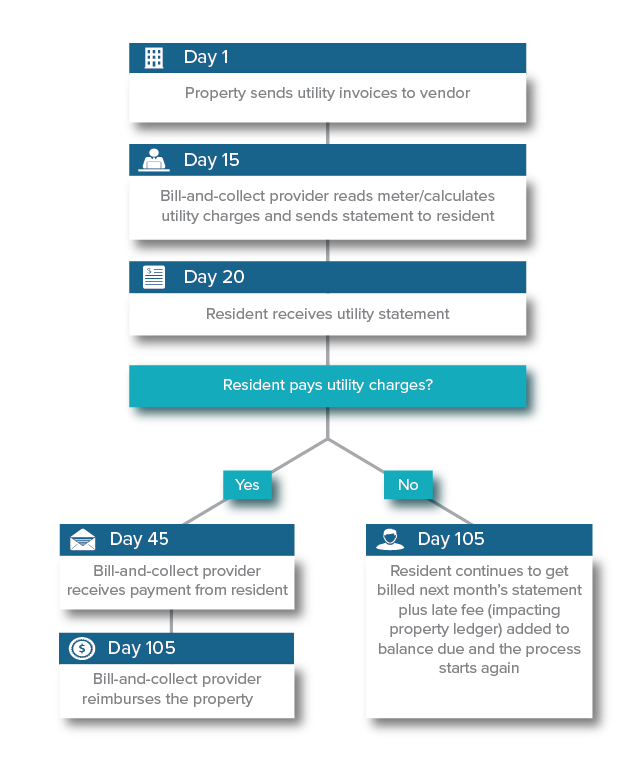

While there are several nuanced differences between the models, the extended time period that it ultimately takes to be reimbursed for the property’s utility expenses is one of the biggest drawbacks to using a bill-and-collect provider. In a utility bill-and-collect model, the provider acts as a middleman that collects utility payments from residents.They subtract their service fees and any resident late fees and the property management company is reimbursed the remaining funds.

Why the Perceived Benefits of Utility Bill-and-Collect Services are a Lie

As you can see in the chart below, getting reimbursed for your residents’ utility expenses is a long and drawn out process.

Video: Choosing the Right Utility Billing Provider for your portfolio

Take note that the earliest timeframe you can expect to be reimbursed in a bill-and-collect model is approximately 105 days after the property utility bill was received. The extra steps involved in the process significantly delay the time it takes for utility bills to be generated and received. And more importantly: the amount of time for the recouped utility funds to make their way back to the property manager. This leads to inconsistent and slow cash flow. And as you know, timely billing and payments are key to optimizing a property’s cash flow.

Why it Only Takes 30 Days to Get Paid with Resident Billing

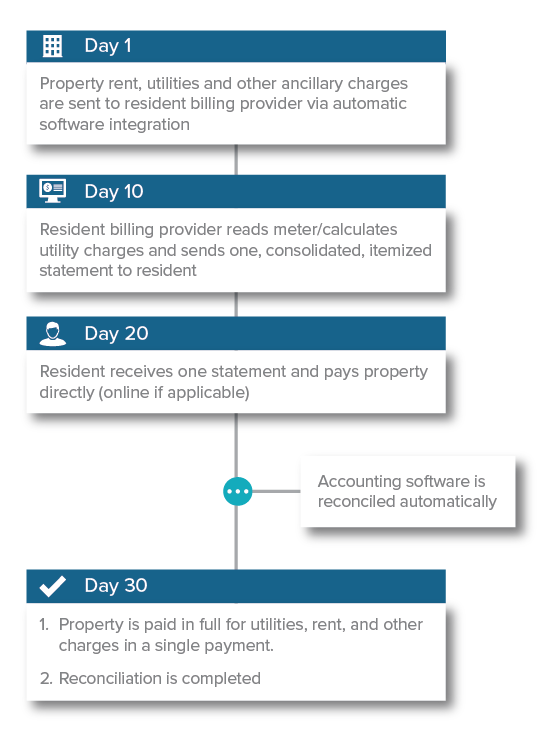

Conversely, in a Resident Billing model, residents receive a consolidated, itemized statement that is generated by the provider and white-labeled so it appears to come from their property management company. Residents remit a single payment for all monthly charges (rent, utilities and any other property charges) through the same online payment system you use to collect rent. And, if you have a best-in-class online payment system with a tight integration you can automatically split funds on the back end for easy accounting reconciliation.

In the chart below you can see how removing the middleman from the equation drops your funding time from 105 days down to 30.

Because residents pay your company directly you don’t have to wait months for a third-party to reimburse you. Plus, you collect any late fees that are assessed rather than forfeiting them to a provider.

As you can see, the extra steps involved in the bill-and-collect process significantly delay the time it takes for management companies to see their funds leading to inconsistent and slow cash flow. That’s why the bill-and-collect model is being abandoned by so many property management companies. If your organization is focused on increasing NOI and growing revenue, a Resident Billing model is much more beneficial for your bottom line. Now that you can distinguish between bill-and-collect and resident billing, you can keep that lifeblood flowing.